how much does the uk raise in taxes

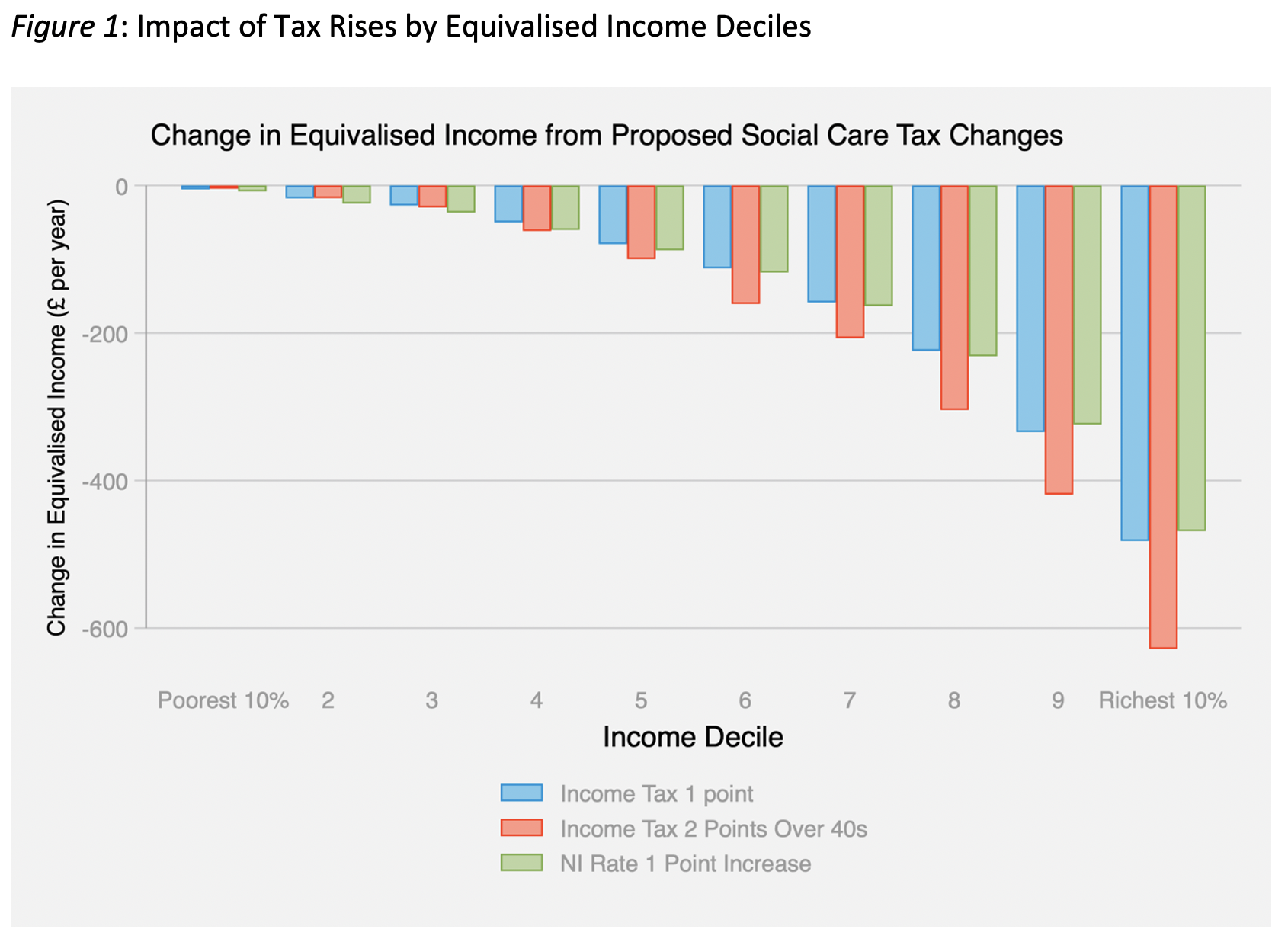

The average rate for the higher earner would increase from 51 to 67 if the UK imported the Belgian tax system. Increasing employee and self-employed National Insurance Contribution NIC rates to 1 percentage point will result in an increase of about 4 billion.

Taxes And Health Care Funding How Does The Uk Compare The Health Foundation

In 201920 income tax receipts in the United Kingdom amounted to 194 billion.

. In 202122 receipts from capital gains tax in the United Kingdom amounted to approximately 149 billion British pounds an increase of approximately 37 billion pounds when compared with the. Prime Minister Boris Johnson has also ruled out cuts to public services and pledged not. Approximately 33000 for every person who pays income tax over just 7 years.

With the potential to raise 70bn a year 8 of total tax revenues taken by the government the financial benefits do add up while the criticisms of wealth taxes simply dont. The poorest 10 pay 4000 in tax mostly indirect VAT excise duty. How Much Would A 1 Rise In Income Tax Raise.

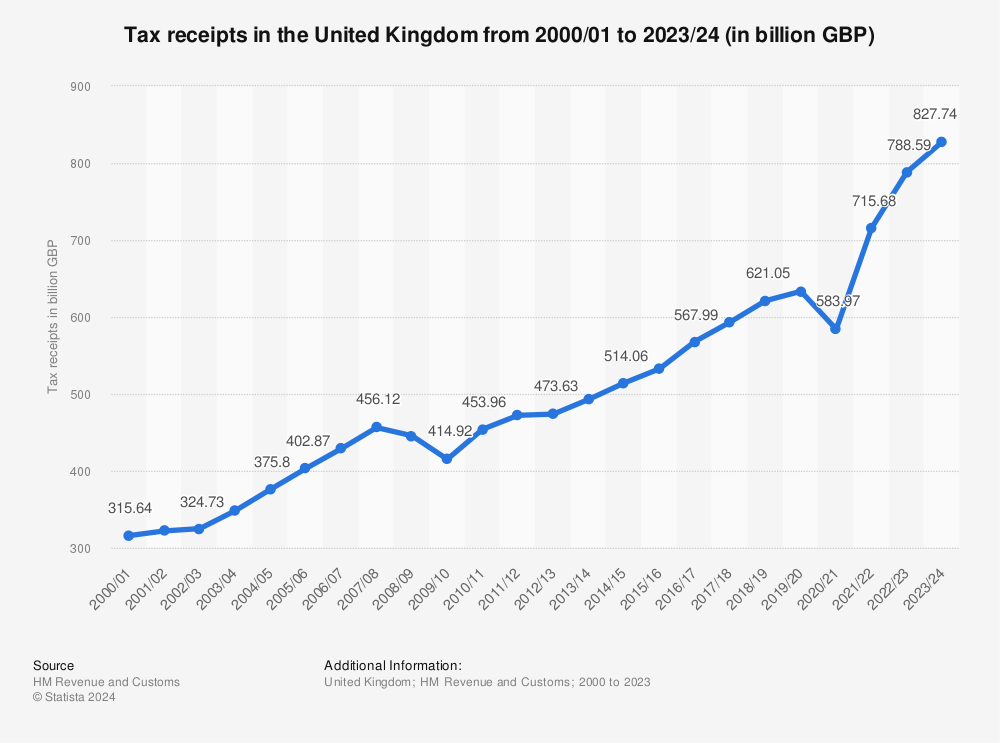

How much does the UK raise in tax compared to other countries. Total tax receipts in 201718 are forecast to be 690 billion. They receive around 2000 in benefits.

If you make more than 50000 in 20202021 you qualify for the higher rate threshold which means that you need to pay 40 tax on any income you earn over this amount. Taxes as defined in the National Accounts are forecast to raise 6229 billion equivalent to roughly 11800 for every adult in the UK or 9600 per person. A basic tax rate of 20 applies to everyone who earns between 12501 and 50000.

In 202021 the UK Government is expected to receive 873 billion of public sector current receipts. Britains middle class faces 30billion tax raid to pay for coronavirus bailout with capital gains and corporation taxes both set to be raised. In 2019 National Insurance contributions the UK version of SSCs raised 66 of GDP.

The increased taxes will raise almost 36 billion 496 billion over the next three years according to the government with money from the levy going directly to Britains health-. It wishes to be the party of sound public finances but also wants to avoid raising taxes. The biggest difference between the UK and most higher-tax countries is the amount of revenue raised through social security contributions SSCs levied on employees and employers.

Since 200001 this total has increased by 89 billion. The richest 10 pay over 30000 in tax mostly direct income tax. Interest on the National Debt.

Chancellor Rishi Sunak has presented two Budgets already and faces introducing UK tax rises to pay for unprecedented levels of public spending. A 1 tax on the use of the policy would be raised by Labour the party claimed. 2000 2009 inclusive.

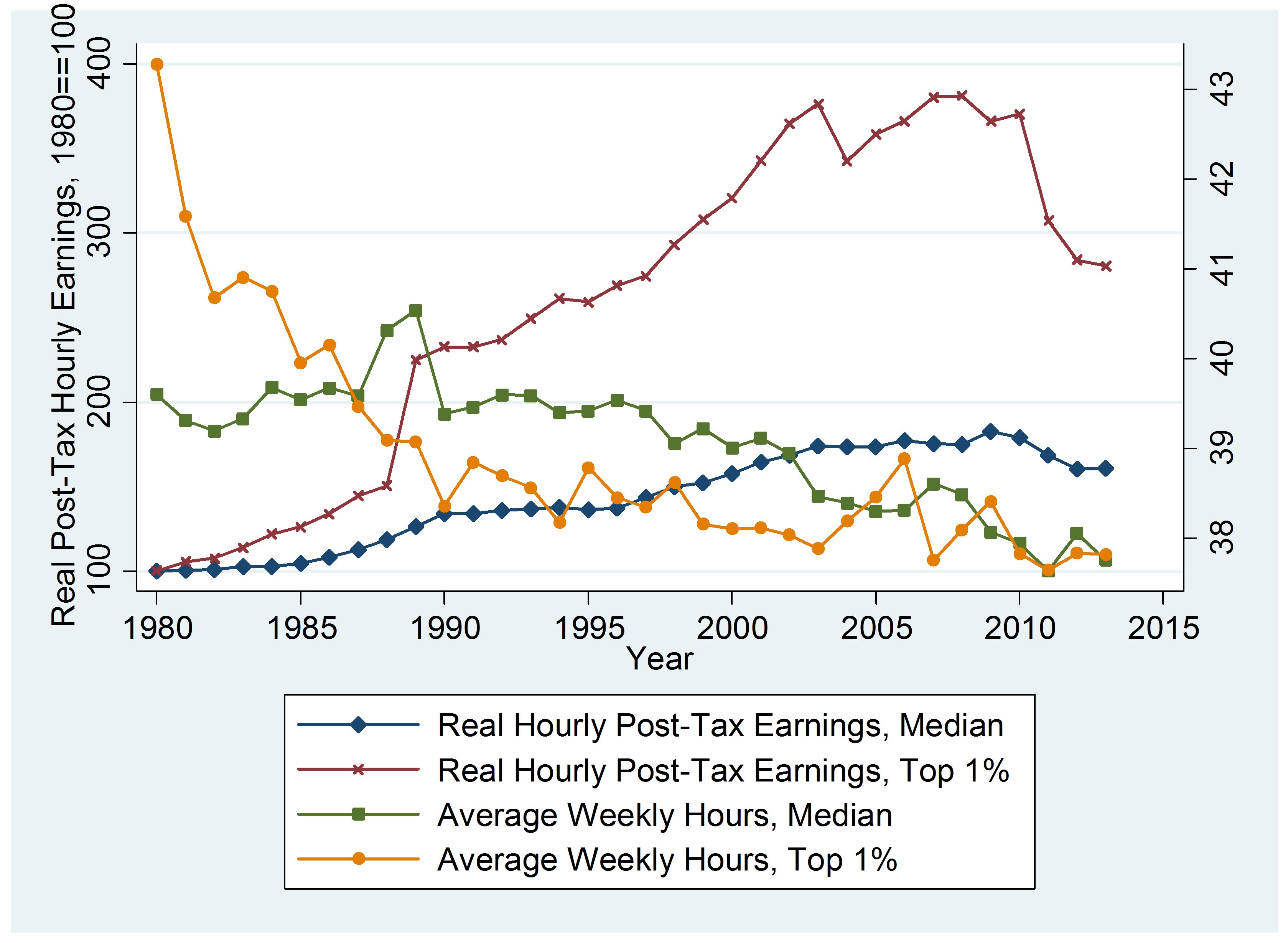

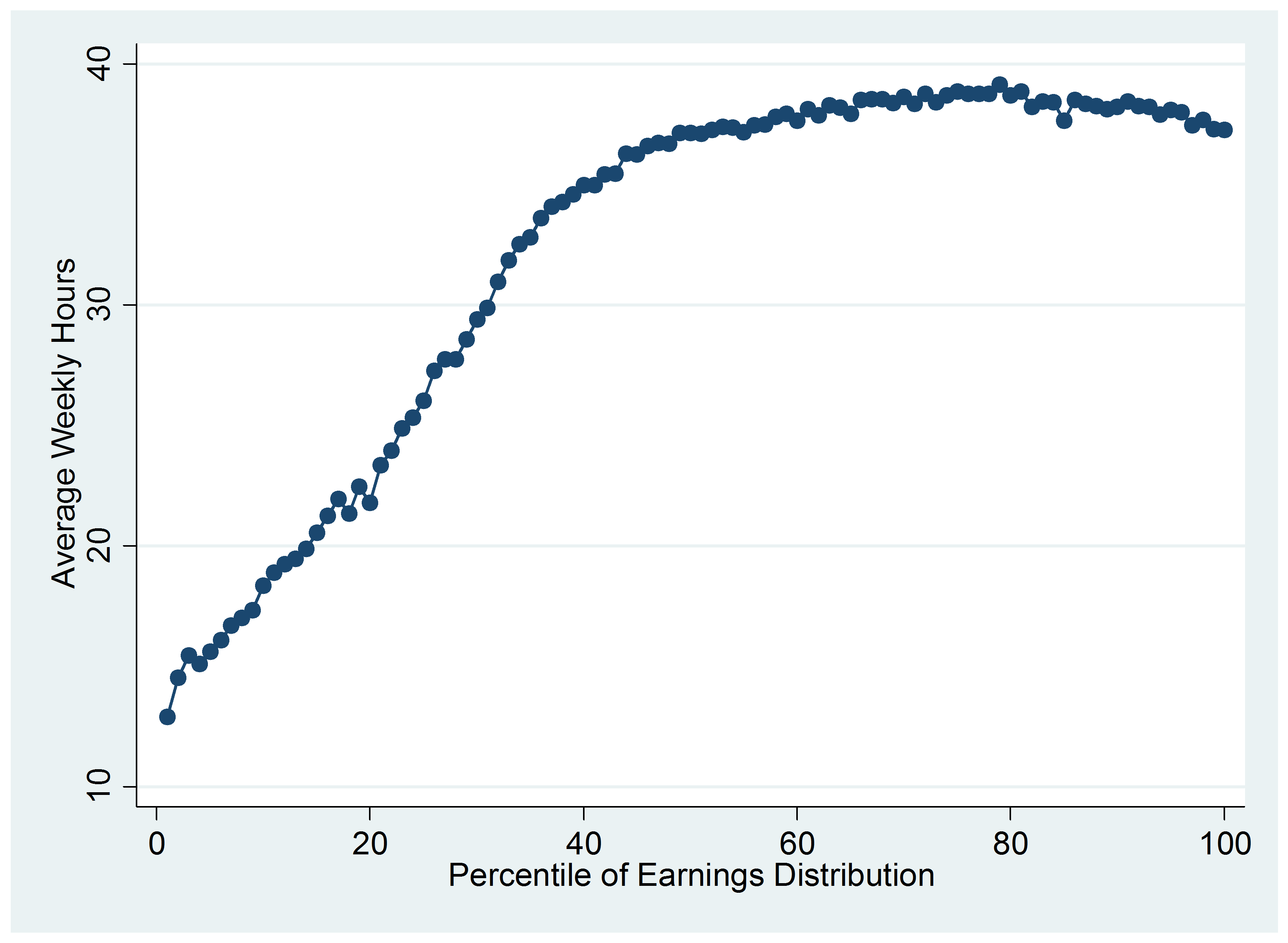

However inequality in the UK has increased since 1980. Overall the average household pays 12000 in tax and receives 5000 in benefits. Tax on share dividends will also be increased by 125 percentage points in a move expected to raise 600m.

In 202122 the value of HMRC tax receipts for the United Kingdom amounted to approximately 71822 billion British pounds. Much of the revenue initially. Receipts have recovered their pre-recession share of national income and on current policy are set to rise slightly as a share of national income between now and 201920 and then remain relatively flat until the end of the forecast horizon Figure 1.

This upper limit is 79 higher than it was in 20182019 46351. This represented a net. Johnson had promised to.

But receive over 5000 in tax credits and benefits. United Kingdom UK finance minister Sunak resigns article with image July 5 2022 United Kingdom British health minister Javid resigns plunging government into chaos article with image July 5 2022. If all rates of income tax were to increase 1 percentage point each it would raise 5 more.

That would be an extra 91000 in tax revenue per person. If the government had created this money instead of the banks taxpayers would have been able to pay up to 1 trillion less taxes.

Uk Slaps Windfall Tax On Oil And Gas Giants Over Rising Energy Bills

The Top Rate Of Income Tax British Politics And Policy At Lse

How Do Us Corporate Income Tax Rates And Revenues Compare With Other Countries Tax Policy Center

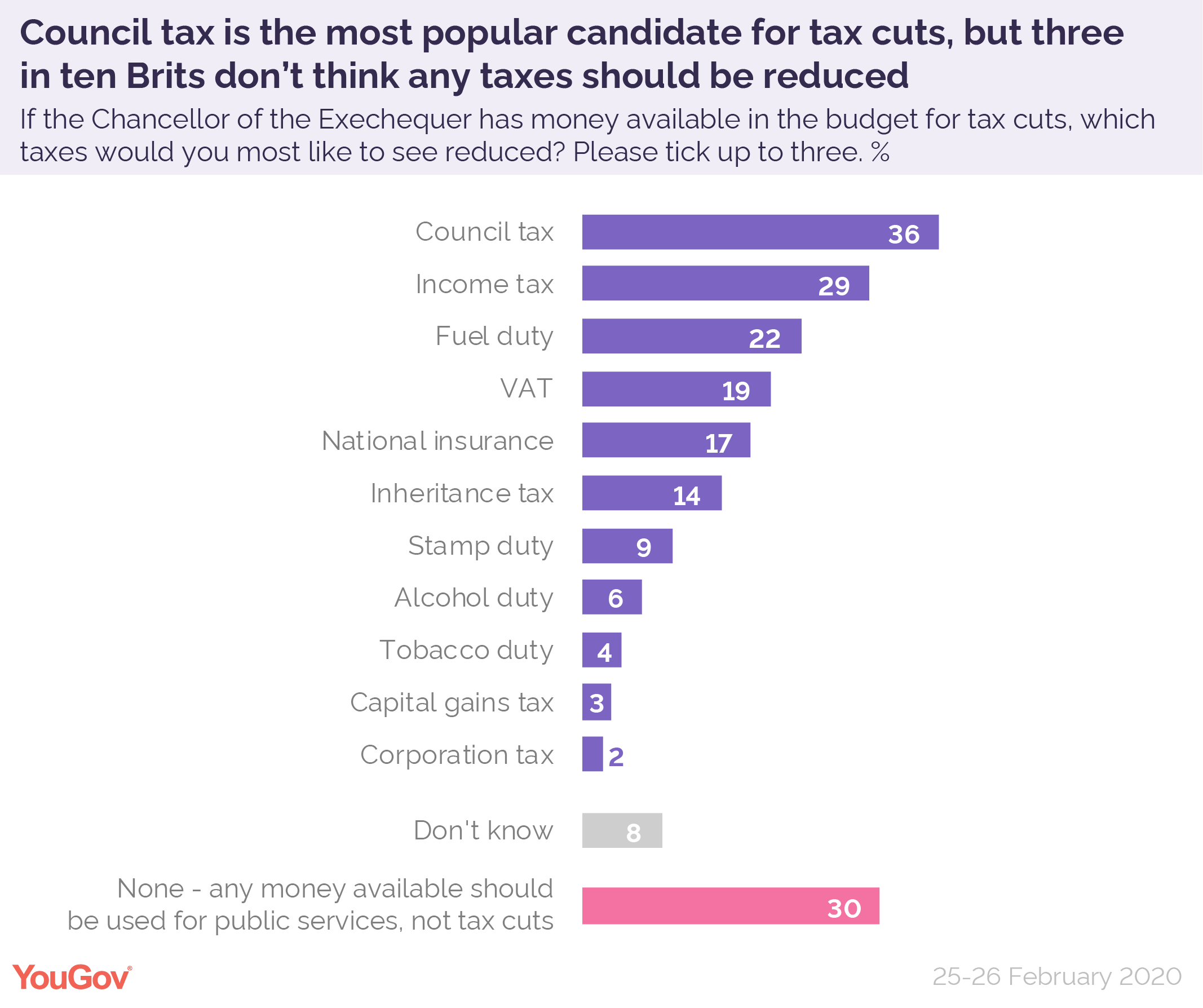

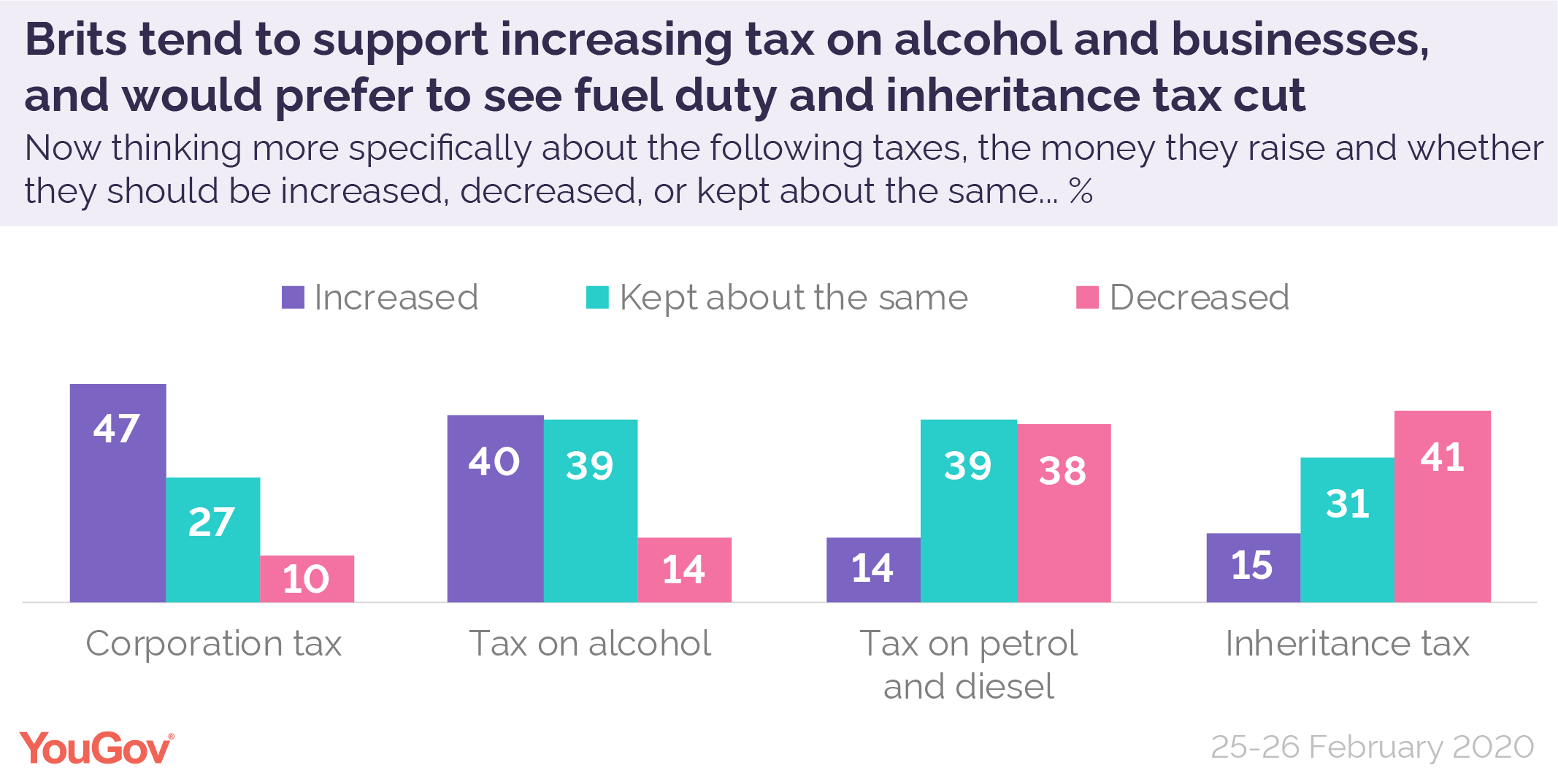

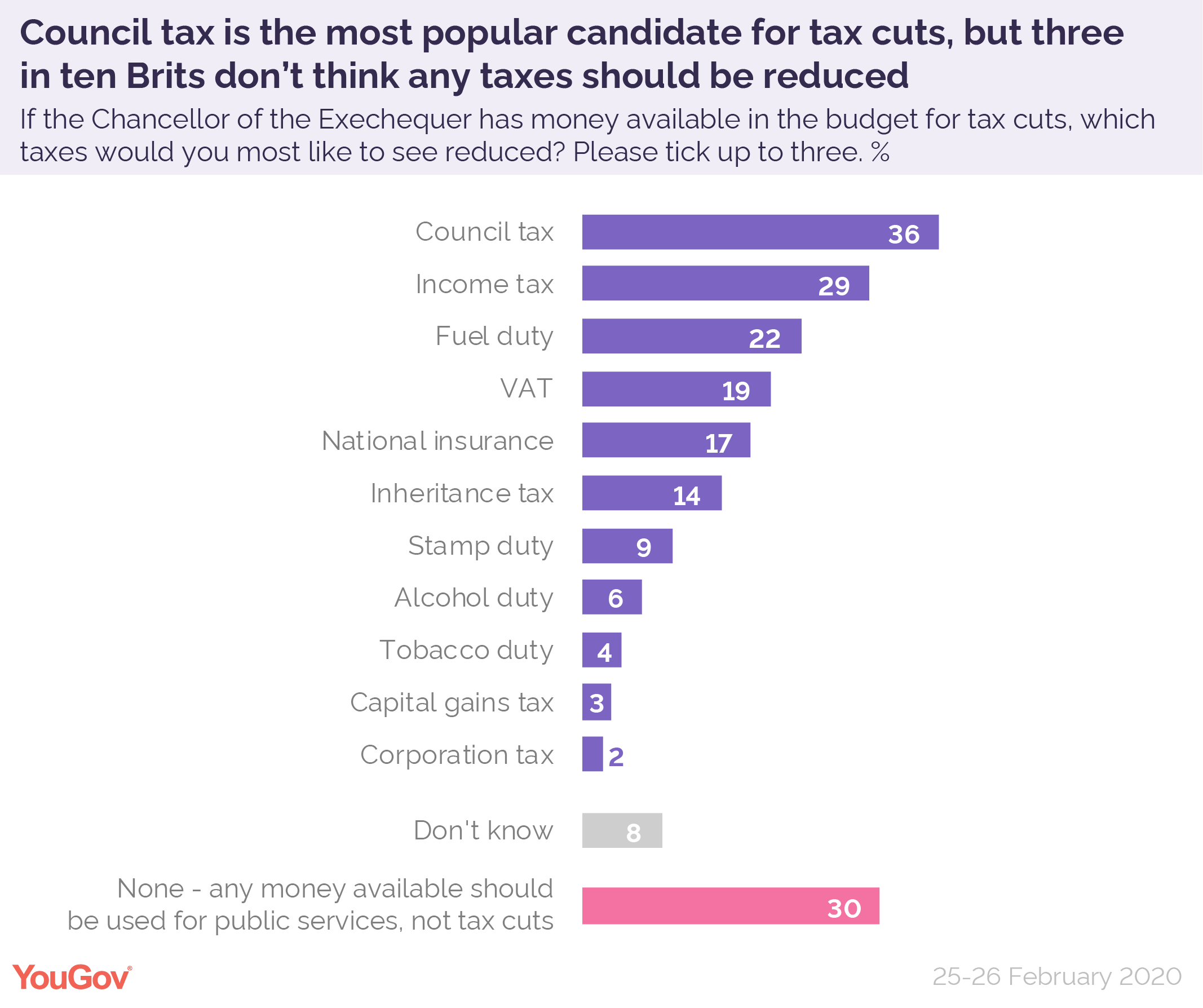

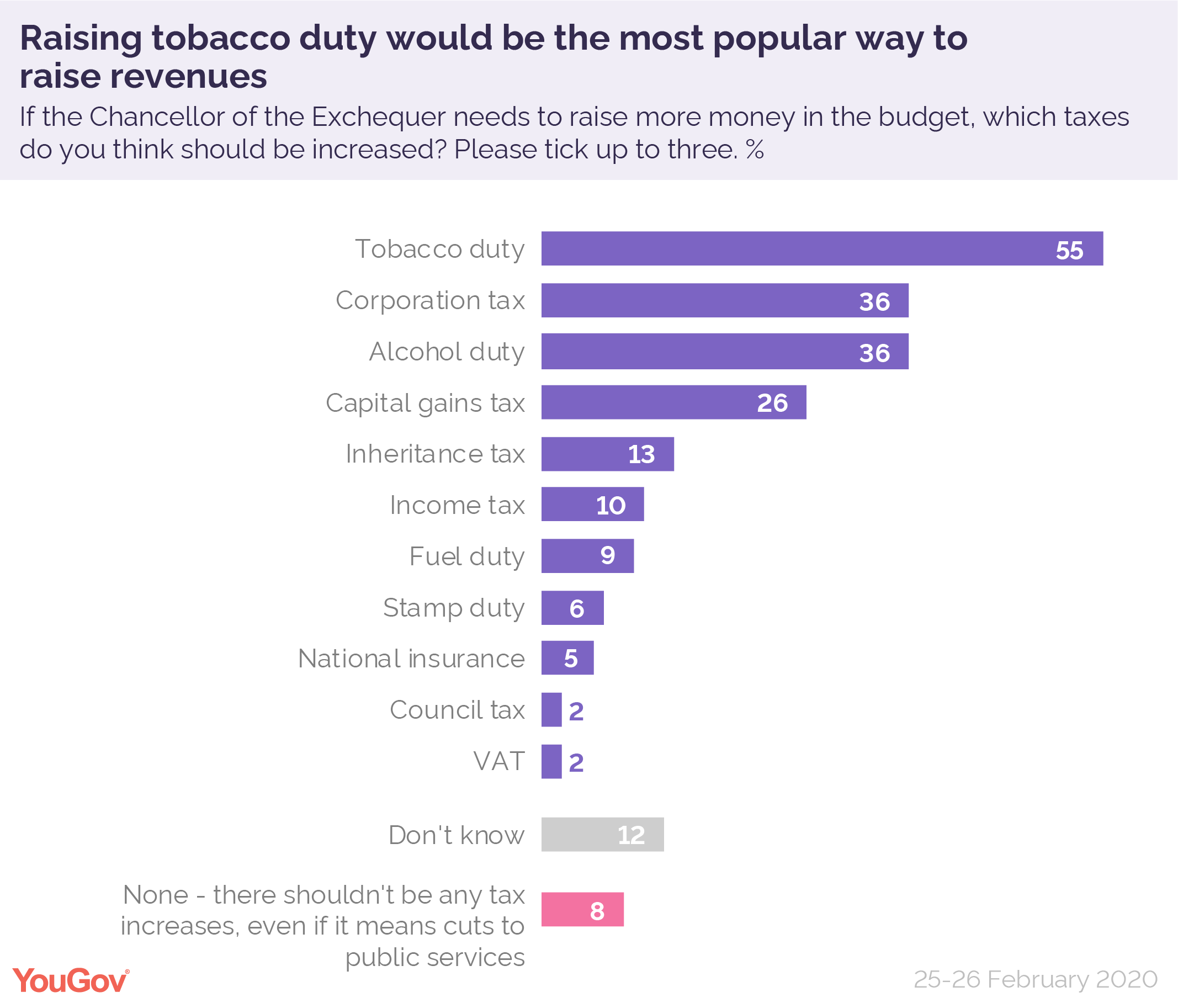

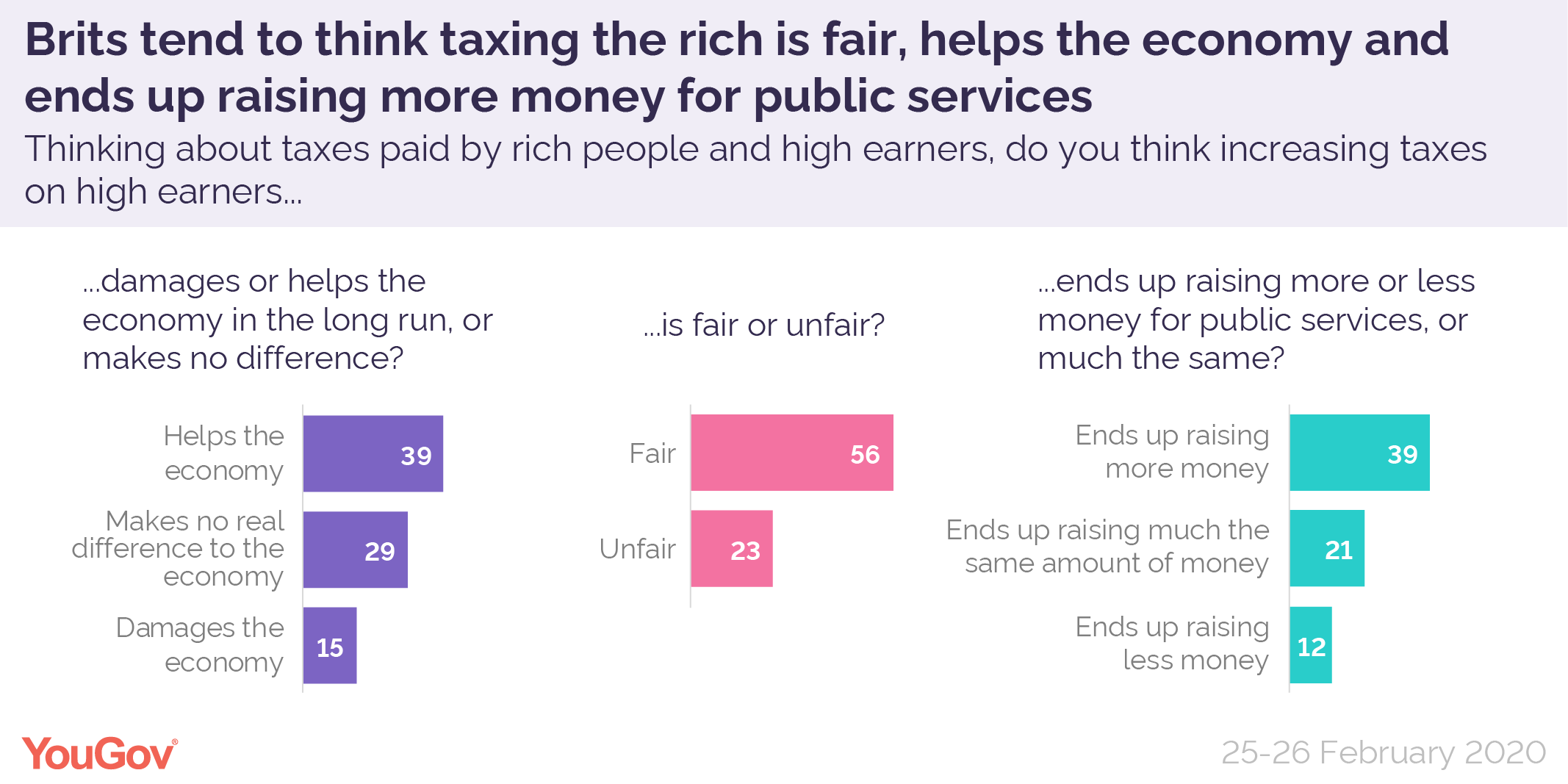

Budget 2020 What Tax Changes Would Be Popular Yougov

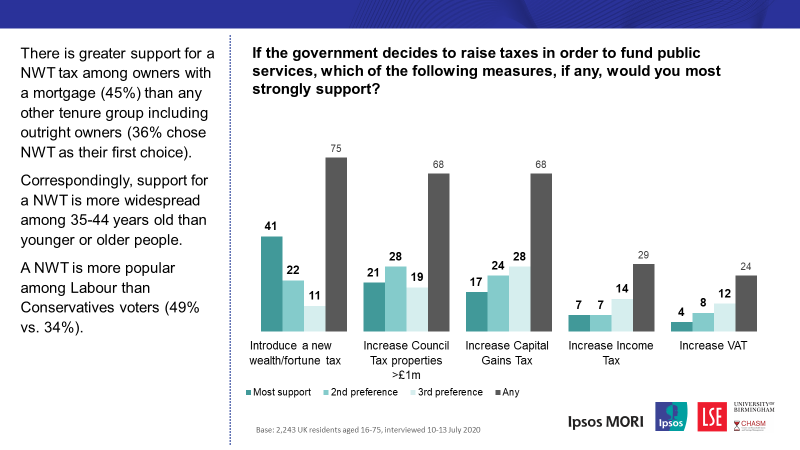

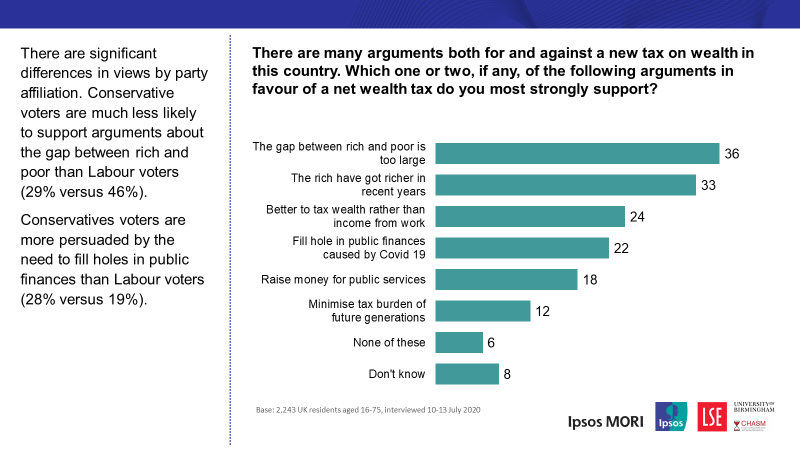

Britons Support Paying More Tax To Fund Public Services Most Popular Being A New Net Wealth Tax Ipsos

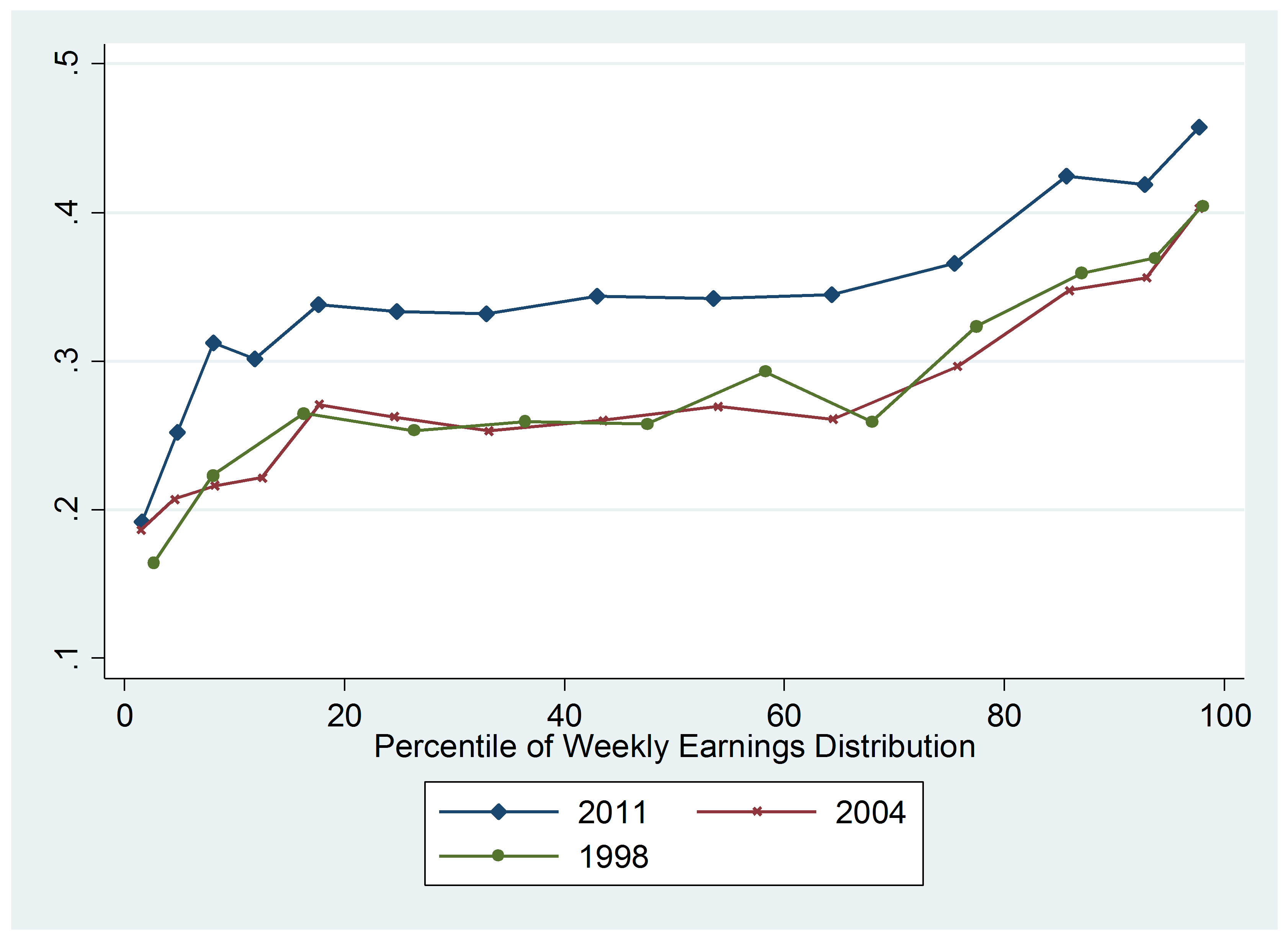

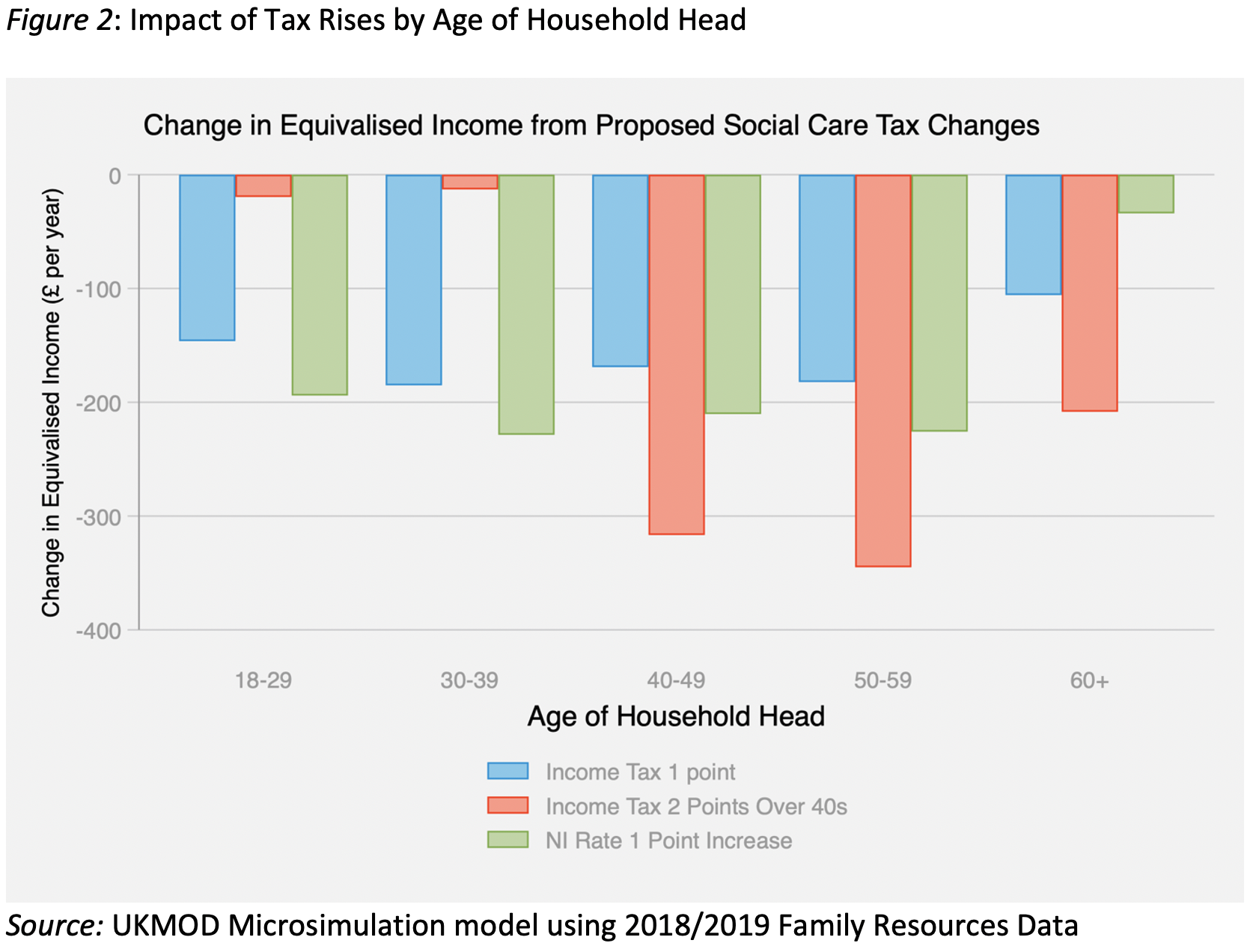

Young People Without Rich Parents Will End Up Paying For A Rise In National Insurance To Fund Social Care British Politics And Policy At Lse

Boris Johnson And Rishi Sunak Have Announced Tax Rises Worth 2 Of Gdp In Just Two Years The Same As Tony Blair And Gordon Brown Did In Ten Institute For

How Do Taxes Affect Income Inequality Tax Policy Center

Britons Support Paying More Tax To Fund Public Services Most Popular Being A New Net Wealth Tax Ipsos

Budget 2020 What Tax Changes Would Be Popular Yougov

Tax Evasion Among The Rich More Widespread Than Previously Thought The Washington Post

Budget 2020 What Tax Changes Would Be Popular Yougov

Budget 2020 What Tax Changes Would Be Popular Yougov

Young People Without Rich Parents Will End Up Paying For A Rise In National Insurance To Fund Social Care British Politics And Policy At Lse

Boris Johnson And Rishi Sunak Have Announced Tax Rises Worth 2 Of Gdp In Just Two Years The Same As Tony Blair And Gordon Brown Did In Ten Institute For

The Top Rate Of Income Tax British Politics And Policy At Lse

The Top Rate Of Income Tax British Politics And Policy At Lse